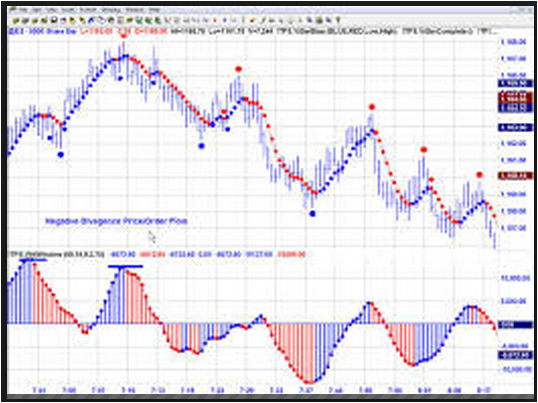

Foreign currency cost developments may be very durable and supply really lucrative Trading possibilities. The actual disadvantage associated with trending Systems is actually they usually have a minimal successful portion. four Hr Golf swing is applicable the amazing filtration system, decreasing the entire quantity quantity deals, so that they can keep your big those who win as well as decrease the amount of dropping deals.

Do you know the Options that come with 4HR swing?

Click Here to Download A NEW Trading Tool and Strategy For FREE

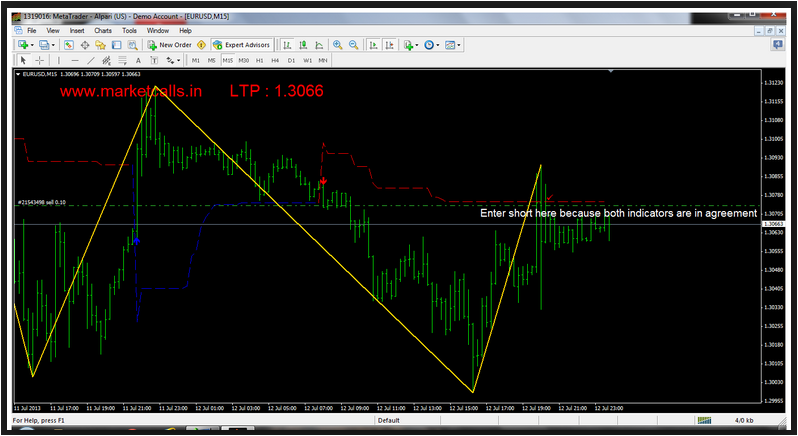

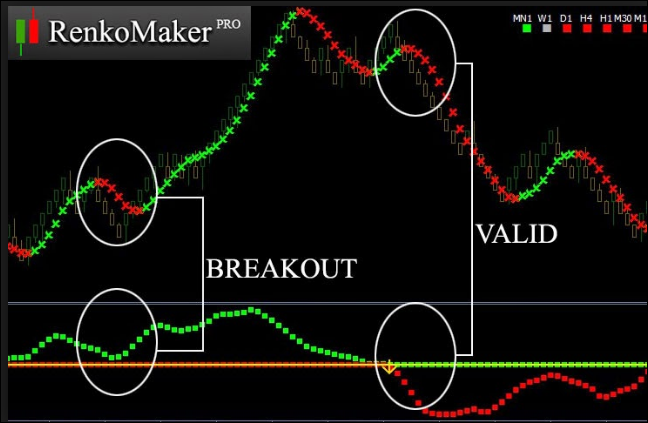

Uptrends are comprised associated with greater levels as well as greater levels. With regard to 4HR Golf swing, a good uptrend is within improvement if your 12-Bar golf swing higher is actually damaged. Then your marketplace should still help to make greater 3-Bar golf swing levels for that uptrend to stay pressure.

Strained 12-Bar Golf swing Levels as well as Levels are utilized with regard to Industry Admittance. In the event that cost surpasses a good admittance golf swing a placement is actually used. The actual System leaves in the event that cost deals via a 3-Bar golf swing. The Trailing Stop can be used following a particular revenue is actually arrived at.

In the event that cost deals from or even over the strained 12-Bar golf swing higher then your System will go lengthy. Next, in the event that cost deals beneath the 3-Bar golf swing reduced then your System may leave. Or else when the selling price offers relocated greater through 2-1/4 % a Trailing Stop starts to operate. A preliminary Stop lack of 1-1/2% associated with cost can be used. The greatest from the leave purchases can be used.

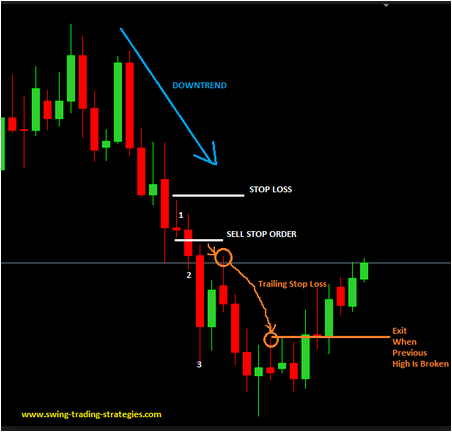

Downtrends tend to be indicated reduce levels as well as reduce levels. With regard to 4HR swing, the downtrend is within improvement if your 12-Bar golf swing reduced is actually damaged. After that the marketplace should still help to make reduce 3-Bar swing levels for that downtrend to stay pressure.

In the event that cost deals beneath the strained 12-Bar golf swing reduced then your System will go brief. Next, in the event that cost deals over the 3-Bar golf swing higher then your System may leave the actual brief placement. When the selling price offers relocated within gain more than 2-1/4 % (of the actual admittance price) a Trailing Stop starts to operate. A preliminary Stop lack of 1-1/2% associated with cost can be used. The cheapest from the leave purchases can be used.

In order to industry while using System you must know it’s indicators because carefully as you possibly can.