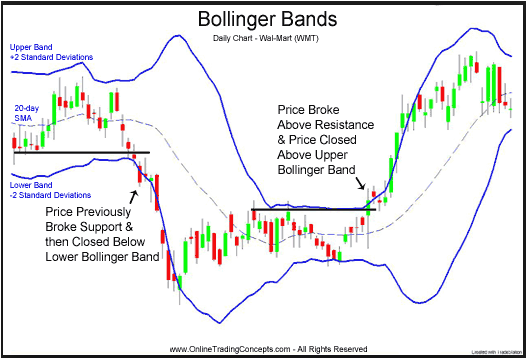

Bollinger Bands® is a specialized graph or chart guage well-known with people all over a few finance marketplaces. For a graph or chart, Bollinger Bands® are generally a few “Bands” that will hoagie sales charge. Several people have tried it mostly to ascertain overbought together with oversold grades. An individual well-known approach may be to distribute in the event the charge hits the top Bollinger Band® and buying as soon as the idea bites reduced Bollinger Band®. The following Technique typically successful with marketplaces that will rebound available within a absolutely consistent selection, referred to as range-bound marketplaces. With such a sector, the amount bounces heli-copter flight Bollinger Bands® being a tennis ball bouncey concerning a few rooms.

Click Here to Download A NEW Trading Tool and Strategy For FREE

Although selling prices may well from time to time rebound concerning Bollinger Bands®, that Bands really seen as signs to own and distribute, but instead for a “tag”. Since Kim Bollinger was initially to help recognise, “tags in the Bands are merely that will : tag words, not necessarily signs. Some sort of licence plate in the higher Bollinger Band® is not really independently some sort of distribute transmission. Some sort of licence plate in the reduced Bollinger Band® is not really independently some sort of shop for transmission.

Charge quite often may well together with will do “walk that Band”. With people circumstances, people which always keep selling in the event the higher Band is usually attack and investing in in the event the reduced Band is usually attack might are up against a great severe number of stop-outs and more painful, a great ever-increasing flying deprivation since charge goes additionally and additional faraway from the main entry way. Examine that case following on the charge wandering that Band. When a buyer possessed available when the top Bollinger Band® has been described, he’d are generally serious in debt.