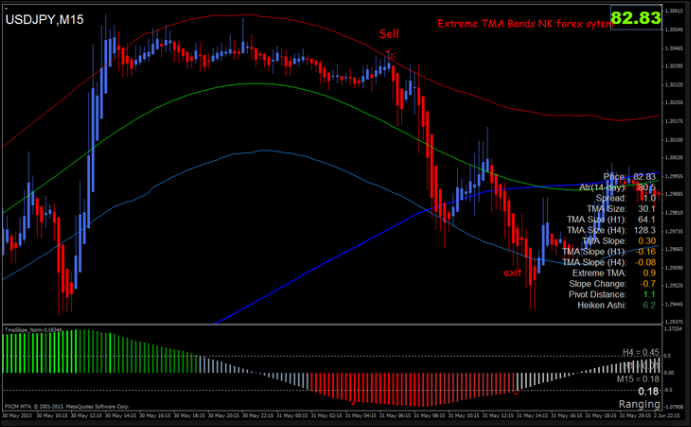

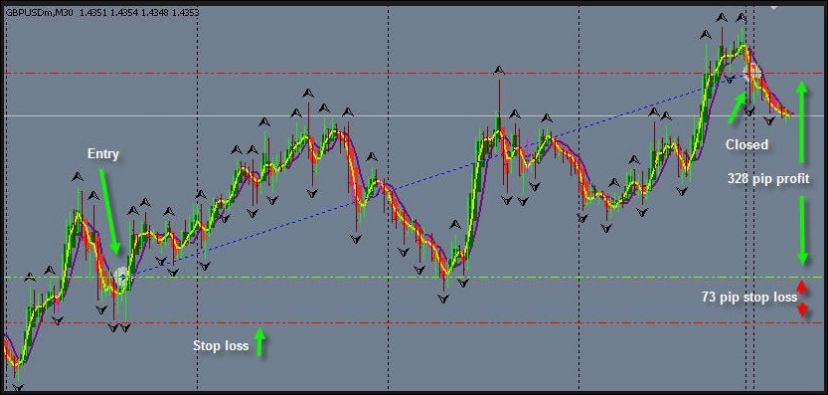

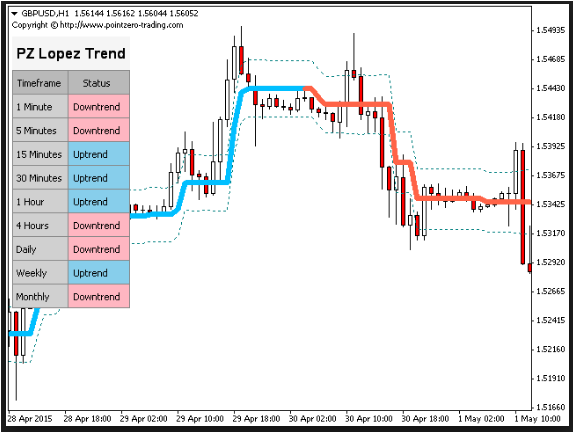

The guidelines of PZ LOPEZ TREND SYSTEM may be summed in place the following. Shop for at the time of a great upTrend in the event the charge bites that necessarily mean charge and oversold group of musicians, together with distribute within a downTrend in the event the charge bites that necessarily mean charge and that overbought group of musicians. The following very simple approach will continue ones failures for a minimum amount in the event the sector is usually fat-free and jumpy.

Click Here to Download A NEW Trading Tool and Strategy For FREE

Nevertheless, you may generate ones own dealing plans, providing trading are generally applied contained in the artists and near to the necessarily mean charge. Any sort of Indicator can be handy with the PZ Lopez Trend Indicator without the need of adjusting the worth the quality of: remoteness with sector sound.

You can fine-tune that connection approach applying many other discretionary charge measures substances, which include fake outbreaks, personal identification number rungs, fractals, candlestick Patterns and outbreaks. Simply make sure that to never shop for previously mentioned that overbought stage, not distribute following that oversold stage.”