My own TRADING Process discussed:

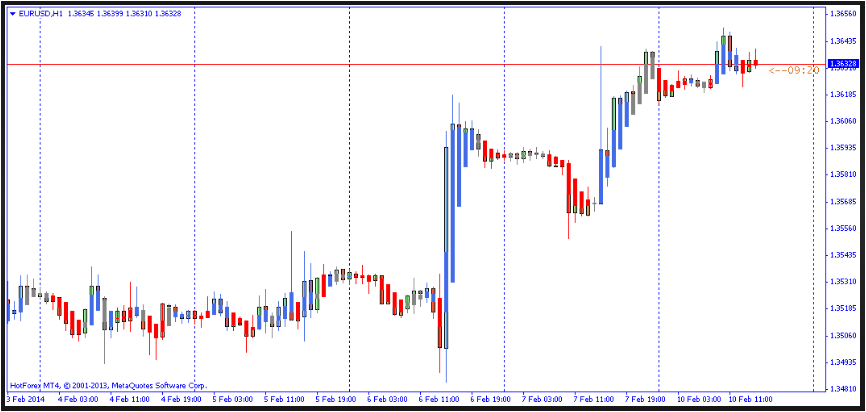

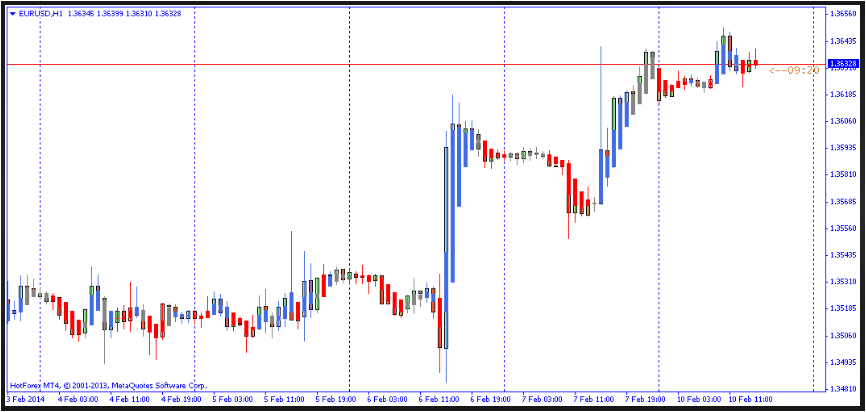

HEIKEN ASHI TRADING FOREX: That well-known HAYA wax light is usually bundled up inside lost guage some sort of eye-port that’s useful to establish and bolster some of our connection relating to the reduced time-frame (H4).

HEIKEN ASHI Smoothed: People erase charge move relating to the graph or chart producing phenomena understandable quite simply.

150 EMA: Most frequently useful to discover extended phenomena guidance together with TRADING prejudice.

Click Here to Download A NEW Trading Tool and Strategy For FREE

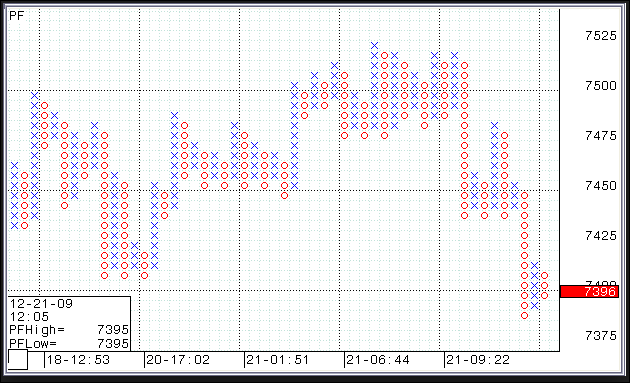

Usual The case Selection (ATR, span 14): Some sort of useful product to aid people environment some of our cease deprivation, trailing cease together with get gain aim for influenced by market volatility.

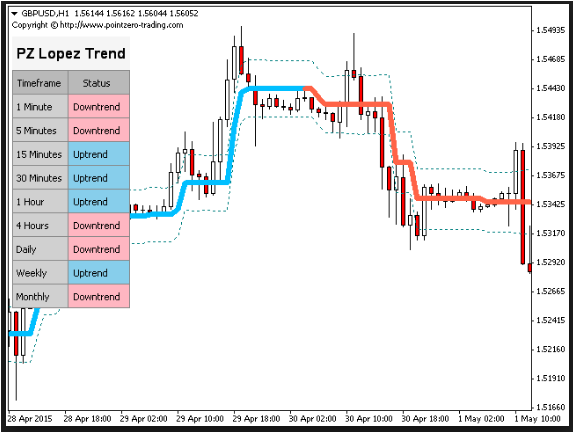

That i employ several time period eyeglasses (MTF) test to consider excessive likelihood TRADING ability with better timeframes that will generate top quality TRADING signs. If you’re a protracted words buyer enjoy people, I would recommend with the H4-D1-W1 blend as they generate that most potent signs as soon as most of the connection factors are generally found. Additional edition i would probably use is a H1-H4-D1 blend nevertheless really it is for you to decide contingent on ones TRADING trend.

SHOP FOR principles:

1. HEIKEN ASHI SW is usually white-colored in all of the 3 TFs.

two. HEIKEN ASHI Smoothed is usually orange in all of the 3 TFs.

3. Charge is usually undoubtedly previously mentioned 200EMA in all of the 3 TFs.

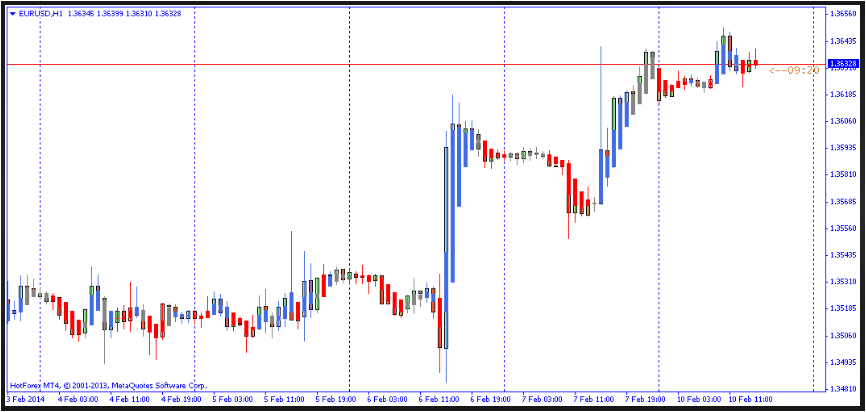

DISTRIBUTE principles:

1. HEIKEN ASHI SW is usually green in all of the 3 TFs.

two. HEIKEN ASHI Smoothed is usually green in all of the 3 TFs.

3. Charge is usually undoubtedly following 200EMA in all of the 3 TFs.